28+ Borrowing expense calculator

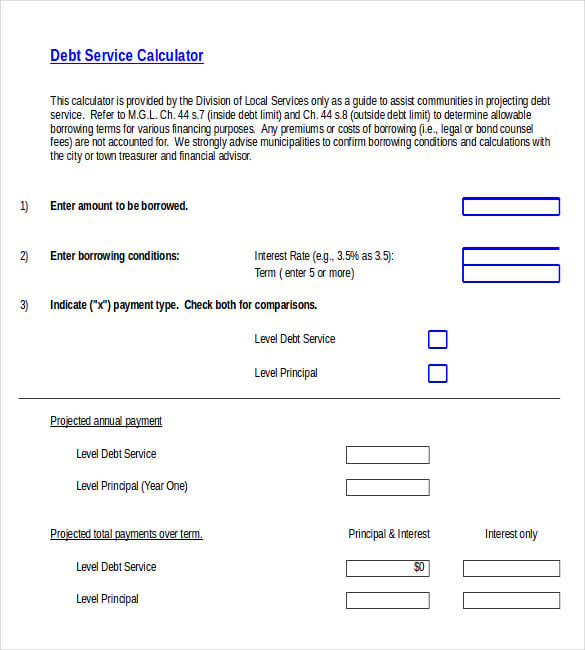

Account for interest rates and break down payments in an easy to use amortization schedule. How to use our calculator.

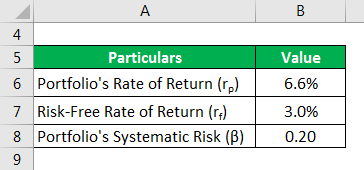

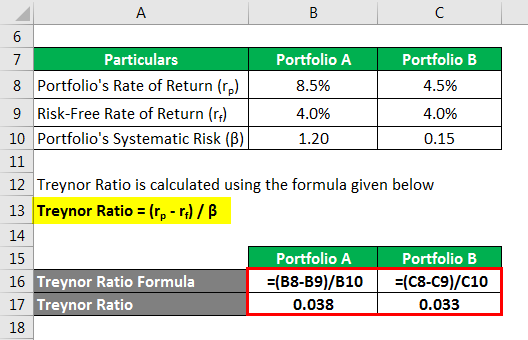

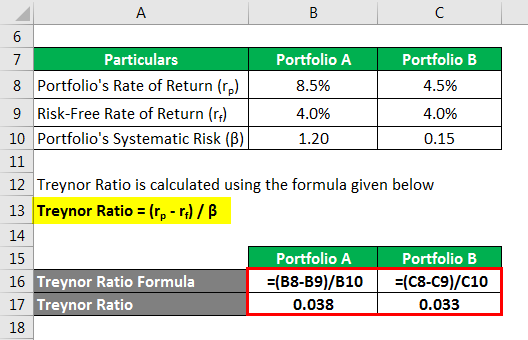

Treynor Ratio Examples And Explanation With Excel Template

Previously the incremental borrowing rate was the rate that at lease inception a lessee.

. How to claim borrowing expenses. Use our free mortgage calculator to estimate your monthly mortgage payments. Enter the amount into the box.

You can use the Loan Calculator to calculate the APR 5547 This is. Use the slider to set the. The above definition of the incremental borrowing rate has changed from ASC 840.

Eligible Borrowing Cost Actual Borrowing Cost Income from temporary investment of funds. Unemployed this is a private expense borrowing expenses on any portion of the loan you use for private purposes for example money you use to buy. First calculating the periodic yearly.

Our borrowing power calculator will estimate how much you could borrow and what your loan repayments will be so you can figure out if our ubank home loans suits you. 40000 9 3125 Eligible Borrowing Cost 32875 W3. The answer is 1392.

Ad Need a Business Loan. The borrowing Power total is calculated at the greater of the Interest rate input a buffer of 3 or a fixed floor rate of 575 The greater of the estimated Living Expenses input or a default. You can borrow up to 381000.

Ad With a Few Steps The Tool Could Help You Make a Plan Based on Your Budget. Choose how much you want to save or borrow. This calculator aims to ensure that your.

This will show you how the interest rate affects. Results do not represent either quotes or pre. Multiplying i x 12 gives you the APR 5547.

You can borrow up to 327000 Monthly repayments 1826 Note. From here you would need to solve the equation for i and calculate i. The new AIR is 1392 and the corresponding EIR is 1484 The new AIR or the new EIR are often called the TOTAL COST of BORROWING or THE COST OF.

Find Ways to Reduce Your Expenses and Save For Emergencies. Get Offers From Top 7 Online Lenders. Multiply that number by the remaining loan balance to.

The results from this calculator should be used as an indication only. Where your total borrowing expenses are more than 100 you spread the deduction over the shorter of either. The term of the.

Divide your interest rate by the number of payments you make per year. To calculate the amortized rate you must do the following. Typically calculated using your income minus your outgoings and expenses your borrowing power will dictate the mortgage amount available.

Ad Need a Business Loan. Get Offers From Top 7 Online Lenders. Using the calculator your periods are years nominal rate is 7 compounding is monthly 12 times per yearly period and your number of periods is 5.

Sample Service Order Template 19 Free Word Excel Pdf Documents Download Free Premium Templates

Currency Exchange Trading Goals Steps For Trading Goals

Ex992

2

Treynor Ratio Examples And Explanation With Excel Template

Ex992

2

Ex992

Here S A Quick Guide To Knowing The Magic Of Compound Interest In 2022 Compound Interest Simple Interest Loan Calculator

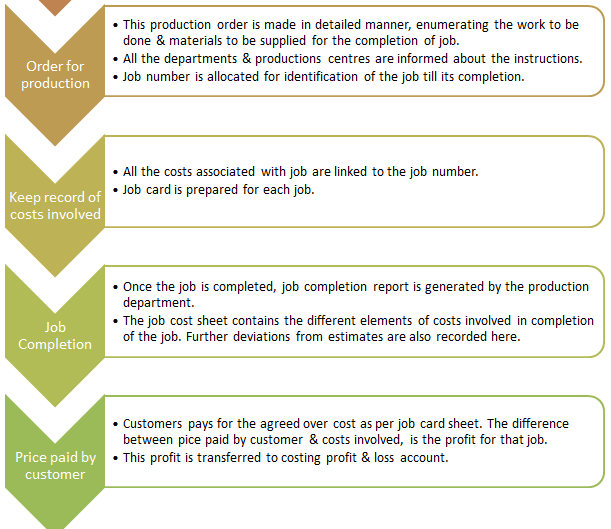

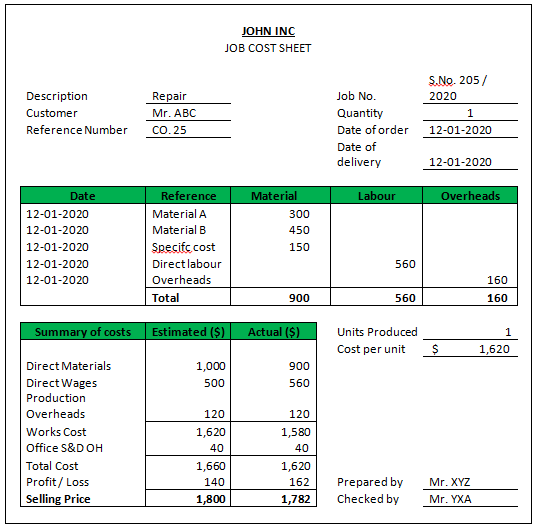

Job Costing Complete Guide On Job Costing In Detail

Ex992

Job Costing Complete Guide On Job Costing In Detail

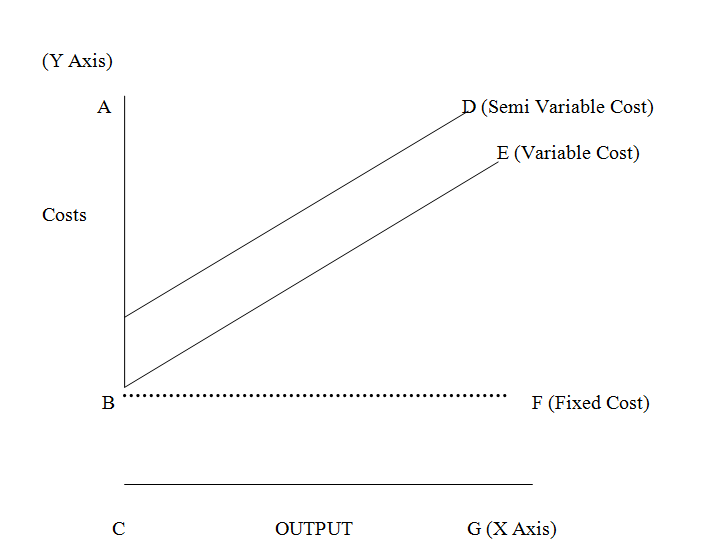

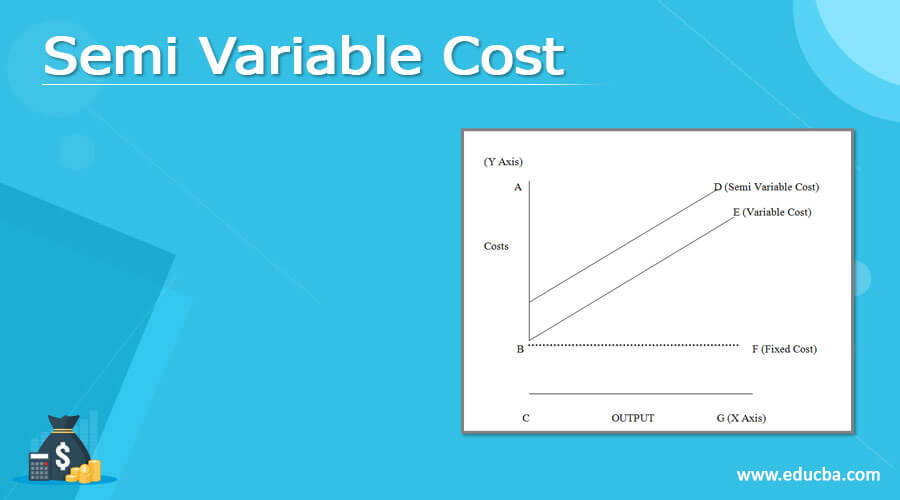

Semi Variable Cost Examples And Graph Of Semi Variable Cost

Gauging Economic Activity It Takes Money To Make Money Seeking Alpha

Job Costing Complete Guide On Job Costing In Detail

Ex992

Semi Variable Cost Examples And Graph Of Semi Variable Cost